It’s budget time for the Regional District of Fraser-Fort George (RDFFG), who today (March 21) approved a budget totalling $51.1 million in expenditures.

Let’s go ahead and unpack that number:

Of the $51.1 million, $19.3 million will be funded through property taxation, which is an increase of $450,000, or 2.4 per cent, compared to 2018.

Most of the other funding for the 2019 budget is coming from grants, user fees, and use of reserve funds.

(via Regional District of Fraser Fort George)

(via Regional District of Fraser Fort George)So what does this mean for a taxpayer in the Regional District? Well, that depends.

If you’re unfamiliar, the RDFFG is a federation of four municipalities and seven unincorporated electoral areas.

It's responsible for providing 92 services to residents in the seven electoral areas and to Prince George, Mackenzie, Valemount, and McBride.

The level of services provided to each of the communities in the region differs depending on their needs, which means taxation differs and there's no overall tax rate.

Also, the RDFFG doesn’t collect taxes directly, so residents can find the requisition amounts as line items on their municipal or provincial property tax notices.

In a news release following the budget approval, Regional District Chairman Art Kaehn explains that an increase or decrease in the overall requisition does not always translate to what residents will see reflected on their tax bill.

The budget can affect communities in the region differently depending on a number of variables such as services provided to that area, fluctuations in property assessments, and a change in the amount of residential or commercial properties that share in the funding of a particular service.

Kaehn says the 2019 budget reflects an investment in capital projects in a number of key areas including solid waste management and the 9-1-1 emergency service.

“We are excited to move forward on some big projects that will improve quality of life for residents in our region without a significant impact on taxation.”

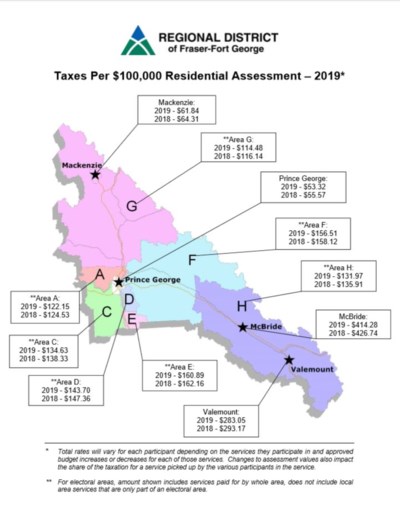

Overall, Regional District taxes per $100,000 of residential assessment decreased in all municipalities and electoral areas for 2019.

In Prince George, the taxes decreased 4 per cent to $53.32 per $100,000 residential assessment.

In Mackenzie, taxes are down 3.8 per cent to $61.84 per $100,000 residential assessment. Valemount will see a 3.5 per cent decrease at $283.05 per $100,000 residential assessment. McBride will see a decrease of 2.9 per cent at $414.28.

However, those decreases may not result in a decrease on the tax bill for many homeowners in the region, depending on the specific services they receive in their area.

The average increase region-wide in property assessment was 6.57 per cent, meaning the overall amount homeowners are taxed on may have increased.

Some of the initiatives the Regional District will be working on this year include a review of the transfer station service levels, developing a region-wide emergency preparedness service, and developing an updated regional parks plan.

To find out more about the Regional District of Fraser-Fort George you can browse its website.