City staff will be subject to what is being described as increased oversight when it comes to cost overruns.

Council voted unanimously in favour on Monday night of a revised policy that will require staff to seek council's permission to amend the operating budget once the cumulative total of differences from the original budget surpasses five per cent of the total.

The city's operating budget sits at about $150 million, which would give staff $7.5 million worth of discretion. Once capital spending is include, the city's budget for this year adds up to about $200 million.

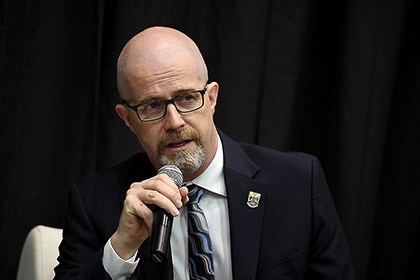

Previously, staff had up to $1 million of leeway per project provided they could find the money within the city's reserves. Coun. Garth Frizzell, who chairs the finance and audit committee, said during council discussion on he item that it left open the potential of giving staff discretion of up to $1 million "as many times as are needed."

Frizzell added that while staff would still likely have come back to council before that threshold is met, the new guideline will "set an exact rate where staff must come back to council."

"So if there is a need to spend $8 million right now in eight chunks, that could happen theoretically, but once these new guidelines come into place, at $7.5 million we will be getting a report back," he said.

In an interview, Frizzell said requiring staff to come back to council every time a specific expenditure was five per cent over budget would be impractical because of the number of projects the city pursues in a year.

"Some of them are quite large but some of them are quite tiny so if you go through on a case-by-case basis for a five-per-cent variance on each of them, a small change in the price of rebar could mean us revisiting many, many different little projects," he said.

"By doing it on the basis of a full operating budget, it still keeps a cap where we've never had one before and brings it to council's attention by guideline."

It was one of a number of changes to the city's guidelines for managing its finances that council approved on Monday night.

Others include:

- Remove a requirement that the tax rate for major industry be compared to the provincial average and cap the property tax rate for business at 2.5 times that for the residential rate.

City finance director Kris Dalio said it's the only tax class where values depreciate, "so unless you have a massive influx of new development in major industry, your rate will increase per $1,000.

"If you're trying to hold it down...that means the other classes are paying for the depreciation of the major industry rate. This has been around for some time and we felt that at this point in time in the city's history, it may be better to focus more on the business tax rate."

- Consider borrowing to fund ongoing capital capital programs rather than limit the move to one-time projects. While an annual levy specifically for road rehabilitation is now in place, Dalio said there are others where "we do need to rely on debt now and then," and pointed to the city's storm sewer system as an example.

- Allow the city to have greater debt from one year to the next. The previous guidelines, last approved in 2013, directed the city to have the same level of debt or lower than in previous years.

"Inflation alone, makes that goal unachievable," Frizzell said in a report to council. "It also indirectly restricts the city from investing in new capital that will promote growth."

There is also a provincially-mandated limit on the amount of debt servicing the city can take on in a given year.

Dalio said it works out to 25 per cent of "controllable" revenue - property taxes, utility fees and reliable grants - which currently allows the city to borrow as much as $250 million in principal.

"We're well below the halfway mark as to what we're allowed to borrow right now," he said.