The Regional District of Fraser-Fort George will be holding a virtual information session on Thursday about its new Housing Needs Report.

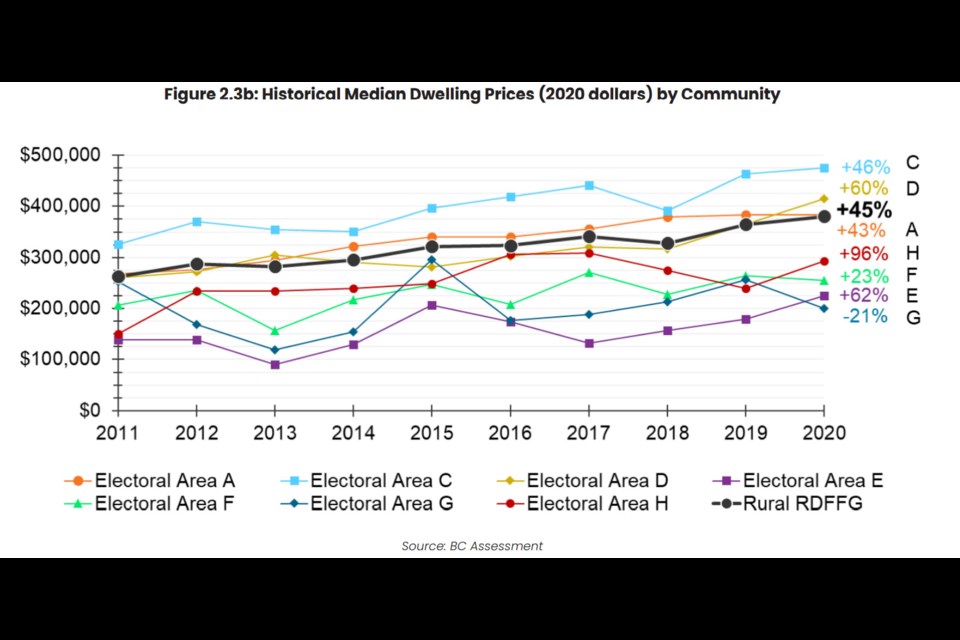

The report, released last month, warns there is a lack of affordable housing in the rural areas of the region. Between 2011 and 2020, the median home price in the rural areas of the district rose by 45 per cent after inflation.

“There are many people in the RDFFG who, five years ago, may have been able to afford market ownership housing but are now unable to because of the accelerated cost,” the report says. “A $100,000 household income could only afford about 62 (per cent) of homes for sale in 2020, compared to 98 (per cent) in 2015.”

The information session will take place online on Thursday from 7 p.m. to 8:30 p.m. via Zoom. For more information on how to participate, go online to www.rdffg.bc.ca/housing.

In addition to rising costs of home ownership, the report highlighted the lack of affordable rental housing in the region.

“Only about (seven per cent) of all residents in the Rural Fraser-Fort George are renters, down from about (nine per cent) in 2006. However, the cost, availability, and condition of rental units was one of the most common concerns identified in the engagement process for this study,” the study authors wrote. “Though most people own their home, most residents have friends or family who are struggling to find a stable and affordable rental situation.”

Of renters who responded to the surveys used for the study, 63 per cent said their current housing was unaffordable.

The median income for renter households was $51,850 per year, compared to $93,000 for homeowning households. Household incomes for renter households grew by 23 per cent between 2005 and 2015, while home-owning households saw a 17 per cent increase over the same period.

“An examination of the proportion of renters that could afford a mortgage, otherwise referred to as potential first-time buyers indicated that, in 2015, about 40 (per cent) of households could afford the mortgage costs of the median home,” the report authors wrote. “By 2020, estimates suggest that this share has decreased to about 33 (per cent). In other words, two-thirds of renter households could not reasonably afford a mortgage for a median dwelling in the Rural RDFFG.”

The report also noted that the district’s rural population is growing and getting older, increasing the need for accessible housing for seniors.

The rural areas of the region saw a three per cent population growth between 2006 and 2016, and are projected to grow a further four per cent between 2016 and 2026.

“However, growth is not even across all Electoral Areas,” the report says. “The Electoral Areas closest to Prince George (A, C, D, and E) saw their population totals increase over the past decade while Electoral Areas F, G, and H decreased over the same period.”

The district’s population is aging, the report authors added. In 2006, people aged 65 and older made up roughly nine per cent of the district’s population. By 2026, seniors are expected to make up 22 per cent of the population.

“These findings indicate a need for housing across the Rural RDFFG that supports the needs of older residents,” the report says. “Specifically, there is a need for more housing that is affordable and accessible for those on a fixed income, particularly within the rental market. An aging population presents a greater need for at home care options and smaller housing units that allow for downsizing.”

The residents of the district aren’t the only ones who are aging, the district’s housing stock is also getting older, the report said.

“Nearly two-thirds of all homes in the Rural RDFFG were built before 1990, and many homes are reaching the end of their lifespan or require significant repair or upkeep,” the report says. “Most importantly, the predominant single-detached stock is not able to evolve to meet the needs of older residents who may be looking for smaller more manageable options.”