Residents across the Regional District of Fraser-Fort George will see a lower tax rate on their property tax bill this year.

On Thursday, the district board approved the district's 2021 operating budget and five-year financial plan. The district will collect a total of $20.1 million in property taxes towards its $60.5 million budget, a 1.43 per cent increase in total tax revenue collected compared to 2020.

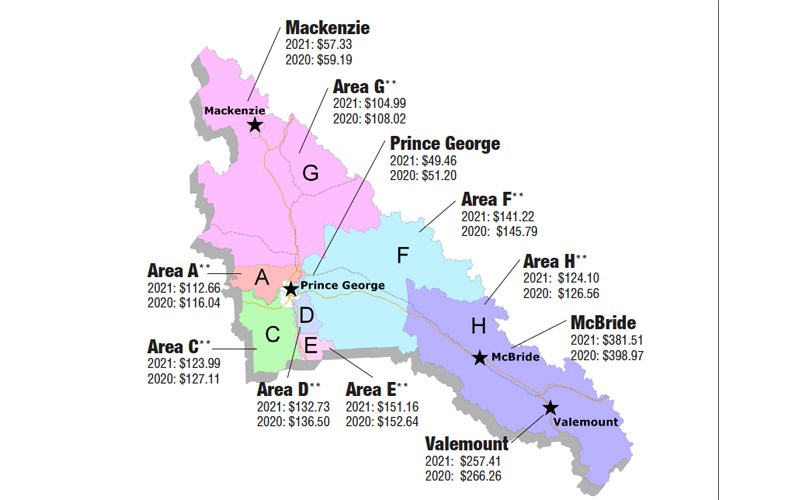

However, the residential tax rate per $100,000 in assessed property value will be lower in all seven electoral areas, Prince George, McBride, Valemount and Mackenzie.

"Thank you for putting together this COVID-19-sensitive budget," board chairperson Art Kaehn told district staff on Thursday. "That is going to take care of our needs for this year and the year to come."

In Prince George, the regional district's portion of the total property tax bill will be $49.46 per $100,000 of assessed value, down 3.4 per cent from $51.20 per $100,000 in 2020.

Residents in the seven electoral areas will pay between $104.99 and $151.16 per $100,000 of assessed value, depending on the services offered in the area.

The lower residential tax rate may not translate to a smaller tax bill for many homeowners in the region, as property assessments are up 6.34 per cent compared to 2020.

Solid waste management is the top expenditure for the district, making up $25.1 million of the total budget, followed by 911 emergency response services ($9.4 million), protective services like fire departments ($7.5 million), and culture and recreation ($4.5 million).

“Over the past year COVID challenged us to deliver services residents rely on, with a focus on the health and safety of our staff and the public," Kaehn said in a press release. "For 2021, we will continue to face that challenge, while moving forward with projects like the Foothills (Boulevard) Landfill entrance relocation, Cummings Road Transfer Station improvements, the relocation of the Fire Operations Communications Centre and the completion of the Public Safety Operations Facility."

For Prince George residents, the regional district property taxes will appear as a line item on their municipal tax bill. City council approved its 2021 budget on Feb. 8, with a zero per cent overall tax increase.

City council has until May 15 to approve a tax rate bylaw, which will set the tax rates for individual property classes. That approval could come as late as council's May 10 regular meeting.

.png;w=120;h=112;mode=crop)