City council approved the first three readings of the city’s tax rate bylaw for 2023 on Monday night.

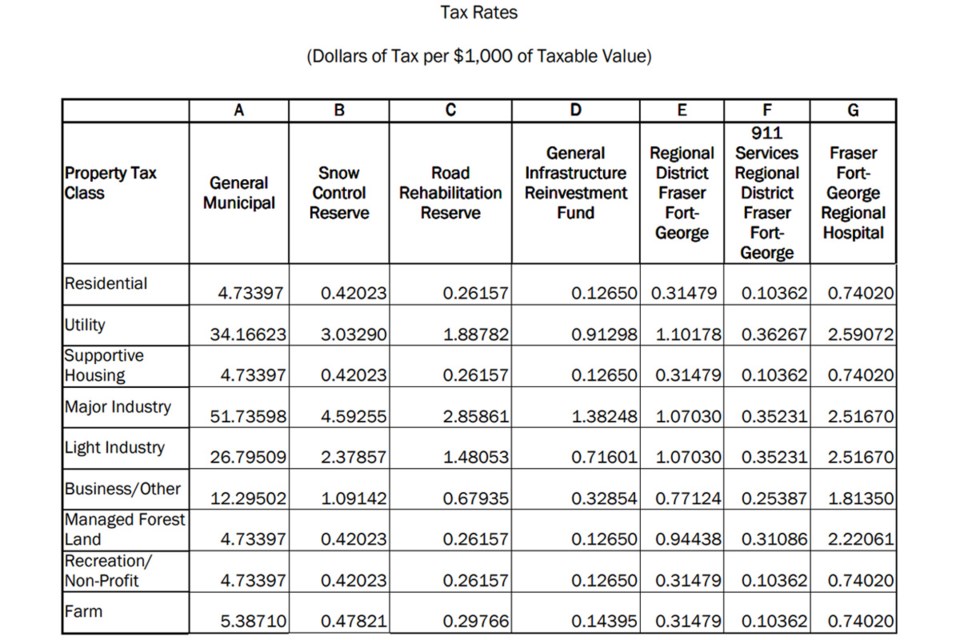

The bylaw sets out the property taxes for each of the nine property classes in the city.

“The financial plan represents the decisions concerning revenues, expenses, debt and transfers that were made by Council during the budget meetings in January and February of 2023. The attached bylaw represents a tax levy increase of 7.58 (per cent),” city director of finance and IT services Kris Dalio wrote in his report to city council. “The tax rates bylaw reflects a modified Tax Rate Option #1 approved by the Finance and Audit Committee on February 27th, 2023 that also froze the Business Tax Rate to the 2022 rate and obtains the remaining tax revenue required by increasing the Major Industrial, Light Industrial and Farm tax rates.”

The residential property class will pay a cumulative $5.54227 per $1,000 in assessed value in municipal taxes, plus a further $1.15861 per $1,000 in Regional District of Fraser-Fort and Fraser-Fort George Regional Hospital District property taxes.

For an average Prince George house, assessed at $449,618 in 2023, those property taxes will total $3,012.84 ($2,490.79 municipal plus $522.05 regional/hospital district).

Homeowners will also pay property taxes collected by the city on behalf of provincial agencies (school tax, BC Assessment, Municipal Finance Authority, etc.), but may be able to subtract the provincial homeowner grant.

In 2022, the property taxes on an average house in Prince George (then valued at $410,891) were $3,666 - $2,366 in municipal taxes, $495 in regional/hospital district taxes, and $805 in school and other provincial taxes, according to data reported by B.C. Statistics.