The Regional District of Fraser-Fort George approved a $55.2 million operating budget for 2023 last month.

Of that budget, $21.5 million will be funded through general property taxes – an increase of $874,129 (4.25 per cent) over the district’s 2022 budget, according to information released by the district. The Regional District of Fraser-Fort George provides 92 services to residents of seven rural electoral areas, as well as residents of Prince George, Mackenzie, Valemount and McBride.

“In 2023, we continue to balance the need to manage rising costs related to regulatory requirements and inflation while making strategic investments in services and capital projects,” district chairperson Lara Beckett said.

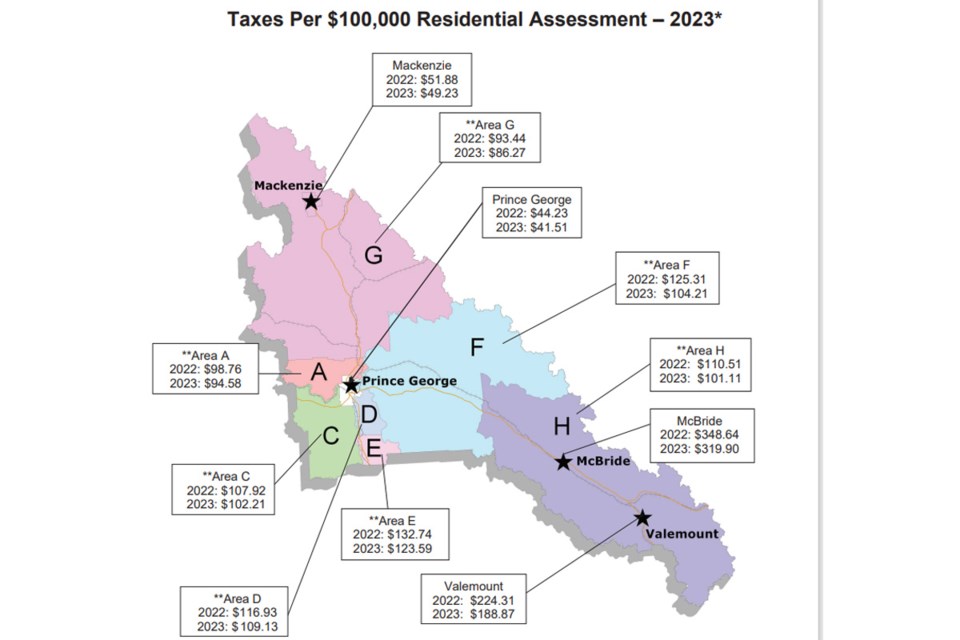

While the total amount of taxes being collected by the district was up in 2023, an 11.76 increase in property assessments across the district means that property owners in all areas of the regional district will see their tax rate per $100,000 of assessed value down this year. In Prince George, the regional district tax rate for 2023 was set at $41.41 per $100,000 assessed value, down 6.1 per cent from $44.23 per $100,000 in 2022.

In Prince George, the City of Prince George collects property taxes on behalf of itself, the Regional District of Fraser-Fort George and various provincial agencies. A tax rate bylaw setting the city’s 2023 tax rates is required by B.C. law to be approved by city council prior to May 15.

During a meeting on Feb. 27, the city’s finance and audit committee approved a recommended 2023 residential tax rate of $5.53442 per $1,000 of assessed value ($553.442 per $100,000 assessed value), down from $5.75774 per $1,000 in 2022.

Under the recommendation, owners of an average Prince George house assessed at $459,865 in 2023, would pay $2,545 in city property taxes and $190.89 in regional district property taxes.

Regional District of Fraser-Fort George residential tax rate per $100,000

Prince George 2023: $41.51, 2022: $44.23

Mackenzie 2023: $49.23, 2022: $51.88

Valemount 2023: $188.87, 2022: $224.31

McBride 2023: $319.90, 2022: $348.64

Electoral Area A (Salmon River-Lakes) 2023: $94.58, 2022: $98.76

Electoral Area C (Chilako River-Nechacko) 2023: $102.21, 2022: $107.92

Electoral Area D (Tabor Lake-Stone Creek) 2023: $109.93, 2022: $116.93

Electoral Area E (Woodpecker-Hixon) 2023: $123.59, 2022: $132.74

Electoral Area F (Willow River-Upper Fraser) 2023: $104.21, 2022: $125.31

Electoral Area G (Crooked River-Parsnip) 2023: $86.27, 2022: $93.44

Electoral Area H (Robson Valley-Canoe) 2023: $101.11, 2022: $110.51

There is no Electoral Area B in the Regional District of Fraser-Fort George.