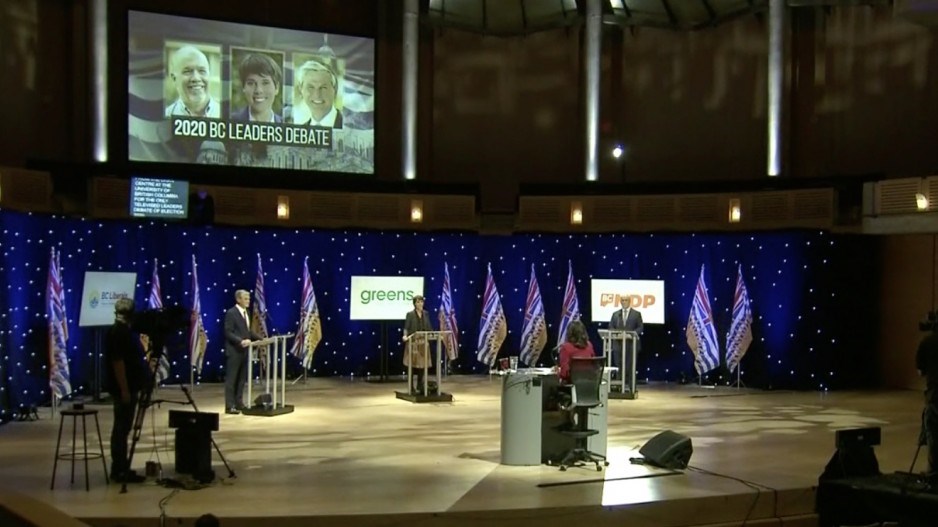

NDP Premier John Horgan, BC Liberal leader Andrew Wilkinson and BC Greens leader Sonia Furstenau jousted on how best to help British Columbians struggling to get by during the COVID-19 pandemic on Tuesday (Oct. 13) in the only leaders' debate before the October 24 election.

Wilkinson many times mentioned his plan to cut the provincial sales tax (PST), while Horgan's plan includes what he calls recovery-benefit cheques, and Furstenau supports existing measures to support people including a rent-relief program for small business owners.

"The BC Liberal Party has a plan, a comprehensive plan that starts with getting rid of the PST for a full year, and then reducing it to three per cent the second year," Wilkinson said.

The proposed PST cut would eliminate the seven per cent tax that is now levied on a wide range of consumer products. Exemptions would include cannabis products and luxury cars.

The tax cut would also eliminate the eight per cent PST levied on hotel rooms, and the 10 per cent PST levied on alcoholic drinks. The 20 per cent PST on vaping products – whether for tobacco or cannabis – would stay in place.

Cannabis retailers have told Glacier Media that they believe the BC Liberals' plan is unfair, as their customers would have to pay the tax, when liquor store customers do not.

The BC NDP’s major plan to put more money in British Columbians’ pockets is what the party is calling a recovery benefit.

Horgan has said households will be eligible for up to $1,000, while individuals will be eligible for up to $500.

The one-time, $1,000 recovery benefit would be given to families that have a household income that is less than $125,000. A sliding scale will provide progressively lower benefits to families that have incomes that range up to $175,000.

Single individuals would be eligible for $500, if their incomes are less than $62,000, with progressively lower amounts given to individuals who earn less than $87,000.

Horgan did not discuss the recovery benefit cheques during the debate so Glacier Media asked him in a post-debate scrum why his stimulus package was better than Wilkinson's plan, and he said that it was because the cheques would be targetted to people who are "struggling," and that "people on middle and low incomes will not be going to tax havens with the $1,000."

He noted that the PST is not charged on essentials such as groceries and rent.

Furstenau similarly did not say much about economic stimulus to individuals during the debate. In a post-debate scrum, Glacier Media asked her what the Greens' plan was on the issue.

After she said her party's full platform will be released tomorrow, she slammed the other parties' proposals and did not sound like she would be in favour of any large stimulus for individuals.

"The problem with just a broad tax cut, or a one-time cash payment, is that you can't really identify what outcomes you want to get from that," she said.

"If you invest those [dollars] in plans and programs like the $1 billion innovation fund for small businesses, or the grants to tourism operators that will allow those families and their employees to make it through this winter, or investing in early childhood education because we know that that is an investment that has enormous economic dividends for all of society, then we can measure: are these investments getting us the outcomes that we want."

The largest targeted bit of stimulus that all parties have made pledges toward is child care. The BC Liberals have a plan that costs $1.1 billion per year, while the NDP’s plan costs $750 million per year and the Greens’ plan costs around $220 million annually.

Horgan promised in the 2017 election much more significant advances toward $10-per-day childcare than he was able to achieve. The debate's moderator, Shachi Kurl, asked him if he still planned to deliver on his goal.

"I'm confident that we can," Horgan said. "We wanted to bring forward $10-per-day child care, our colleagues in the legislature would not support that. So we put in place pilots. We put in place a fee reduction so British Columbians were not paying as much."

Other BC NDP initiatives aimed at providing economic support include making public transit free for those aged 12 years or younger, a rent freeze until 2022, and a $400 renter’s rebate for households that earn less than $80,000, and do not already have rental support.

Economists have told Glacier Media that there are pros and cons to the NDP proposal, as well as to that of the Liberals.

The Liberals’ plan to cut the PST could spur spending by those who can afford to spend because the tax savings only comes into effect when consumers buy goods or services, said Central 1 Credit Union deputy chief economist Bryan Yu.

The flip side of that is that, in many cases, the reason people are not spending is because they do not feel safe to be in stores or restaurants, and not because they do not want to consume.

It may also be harder for the Liberals to raise the PST back to the current level, as it could be seen as a tax hike, Yu said. That would mean less revenue for many years to come if the tax is not replaced.

The NDP’s plan, in contrast, goes to people regardless of whether they are spending money and helping to stimulate the economy, Yu said, meaning that many people could simply “sock away” the one-time benefit, and not spend it immediately.