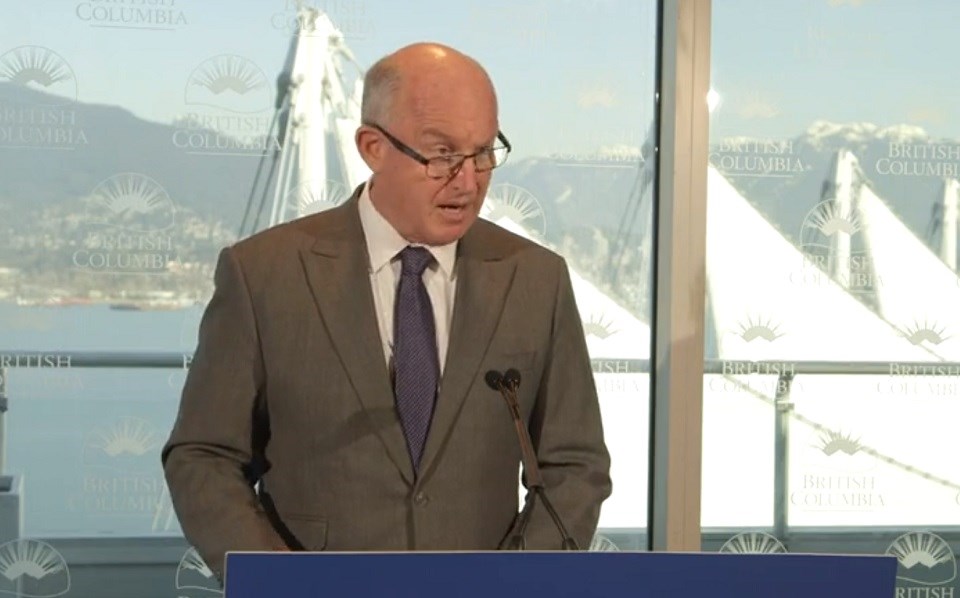

Mike Farnworth, Minister of Public Safety and Solicitor General, announced the largest decrease to basic insurance rates in 40 years.

ICBC is applying to the B.C. Utilities Commission (BCUC) for a 20 per cent decrease on basic and optional vehicle insurance as a result of ICBC's new enhanced care coverage.

Customers can expect to save up to $400 by May 1, 2021.

ICBC will also reduce third party liability rates for optional insurance as of Feb. 1, 2021.

Farnworth said that once the enhanced care coverage begins in the spring, millions of British Columbians will receive a one-time, pro-rated refund.

"Our goal is to leave more money in people's pockets over the longer term," said Farnworth.

The provincial government has also directed that the ICBC basic rate application cover two years instead of one-year. Farnworth says this will help to provide more predictability on lower basic insurance rates until at least early 2023.

The basic rate application also outlines how ICBC will contribute to a fund to help ensure rate stability into the future.

However insurance rates aren’t just about costs, it is also about providing care and service to its customers.

Farnworth said beyond premium savings the enhanced care coverage plan will significantly improve injury and recovery benefits up to a maximum of at least $7.5 million, regardless of fault.

In response to concerns about a backlog of ICBC cases affecting the future affordability of ICBC's new enhanced care program, Farnworth said those cases had already been factored into to the calculations.

Considering Attorney General David Eby called ICBC's finances a "dumpster fire," Farnworth was asked where the money was coming from to support these new insurance premium savings.

Farnworth said moving to a no-fault insurance model combined with new legislation to prevent government from taking ICBC profits to be used for general government spending would create the savings necessary.

The switch to no-fault alone will save the crown-corporation $1.5 billion in litigation fees.