A new bylaw to promote multi-family housing construction could give Prince George a leg up in a competitive development market, city councillors said.

The multi-family housing incentive bylaw gained unanimous approval at Monday night's city council meeting, establishing a framework to reduce development cost charges and tax incentives to builders.

"For me, this is being strategically proactive," said Coun. Brian Skakun. "It's a dog-eat-dog world out there when it comes to tax breaks, incentives, investment."

The new legislation highlights the incentives for housing that consists of three or more attached units that include private balconies or porches or access to a shared green space. Eligible construction or renovation projects would need to have a minimum construction value of $300,000, meet all city bylaw requirements, meet at least three out four specific design standards and be in specific areas of the city.

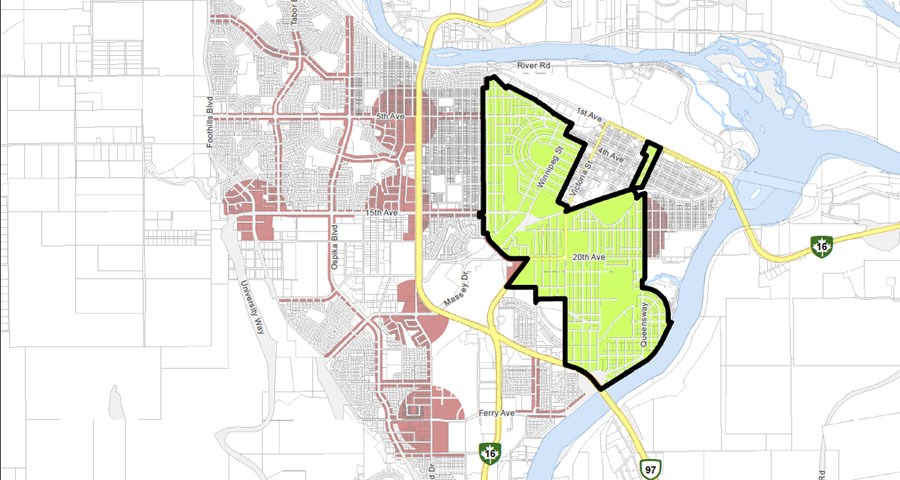

Those areas, categorized as primary and secondary growth areas, are along main roads and served by transit, close to grocery stores, medical services, restaurants and other amenities. The primary growth area consists of downtown and the surrounding area, with pockets of the secondary growth areas on the west side of Highway 97 between Fifth and 15th Avenues, off Ferry Avenue as well as spots in College Heights and the Hart.

"I really strongly believe in this for a number of reasons. One is that we have the opportunity to respond to people who desire a smaller footprint within which to live," said Coun. Susan Scott. While there are people who desire and need more space, "some people have come along that fit within this framework and I think there's going to be nothing but good," she said.

In March, city council was presented with the results of a housing need and demand study conducted by UNBC's Community Development Institute.

The study found there was a mismatch between the available housing stock in the city and the types of households.

More than 60 per cent of housing in Prince George is for single-family dwellings, designed for large families. However the population is shifting to that of an older demographic, small families and empty nesters.

Projects in the primary growth area would be eligible for a 10-year exemption on the municipal portion of their property taxes as well as development cost charges reduced to $229 per unit (instead of the normal $2,295 per unit). Development cost charges would be scrapped entirely for non-profit housing projects.

Projects in the secondary growth areas are eligible for five-year tax exemptions and elimination of development cost charges for non-profit housing.

To receive tax exemptions projects must also have half of their units be adaptable for accessibility. This includes having wider hallways and doorways and a kitchen, bathroom and bedroom on the main floor with a 1.5-metre turning radius.

As chair of the city's homelessness and affordable housing committee, Coun. Murry Krause was effusive in his support for the new legislation.

"The work that the committee did over the years was to prevent homelessness through affordable housing and this, I think, is going to go a long ways to assisting with that goal," said Krause, noting that other communities are already providing similar incentives.

Those other options in other locales are what makes this important for Prince George, said Mayor Lyn Hall.

"When developers come in from out of town and want to take a look at seniors housing, they want to take a look at affordable housing but they automatically question us about our incentive package because they know they can get something elsewhere," Hall said. "During Talktober, we heard loud and clear about seniors' housing and affordable housing. I think there's a mechanism that needs to put in place so we are competitive with the market. This, in my opinion, hits the nail on the head."

The new bylaw has a five-year window for applications.