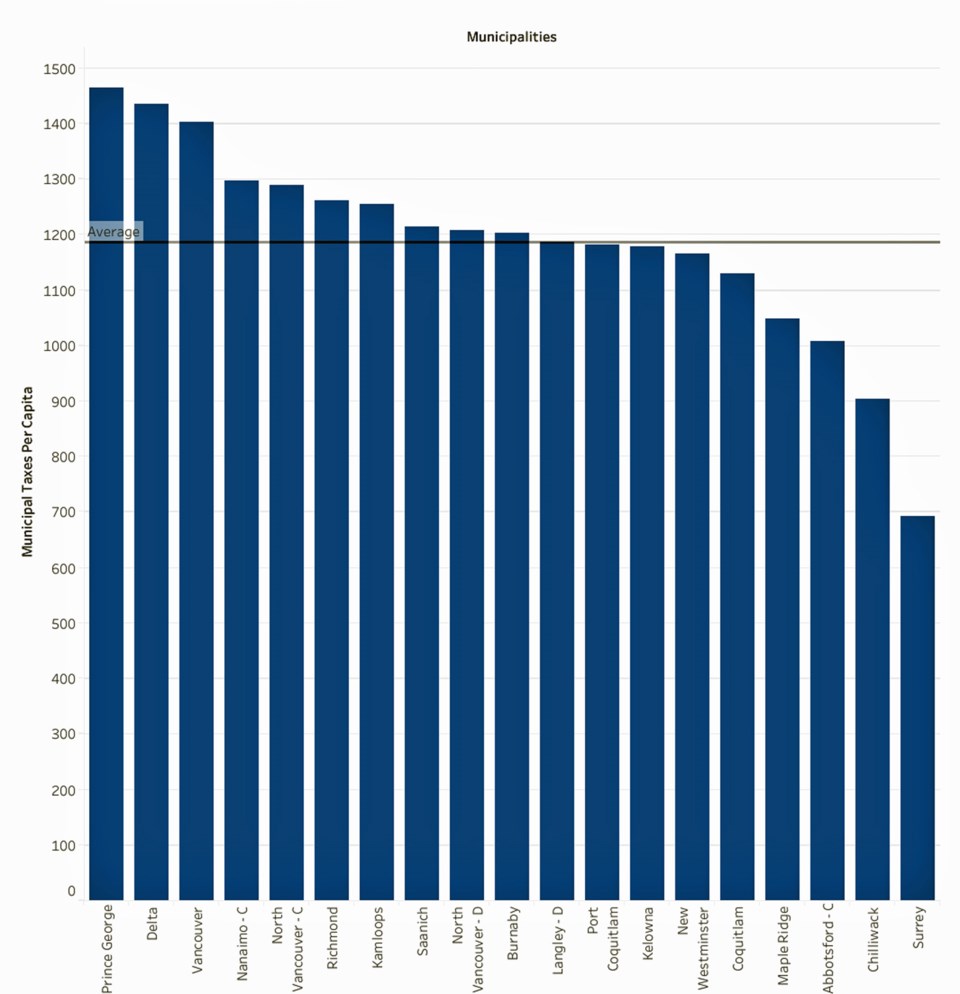

Before discussing the city's tax increase this year, consider some facts around peer comparison. All of the data is freely available from the provincial government.

Prince George has the highest tax rate per person for all communities in British Columbia, with a population more significant than 50,000 people, excluding the capital. Prince George is a full 23.4 per cent greater than the provincial average in this respect.

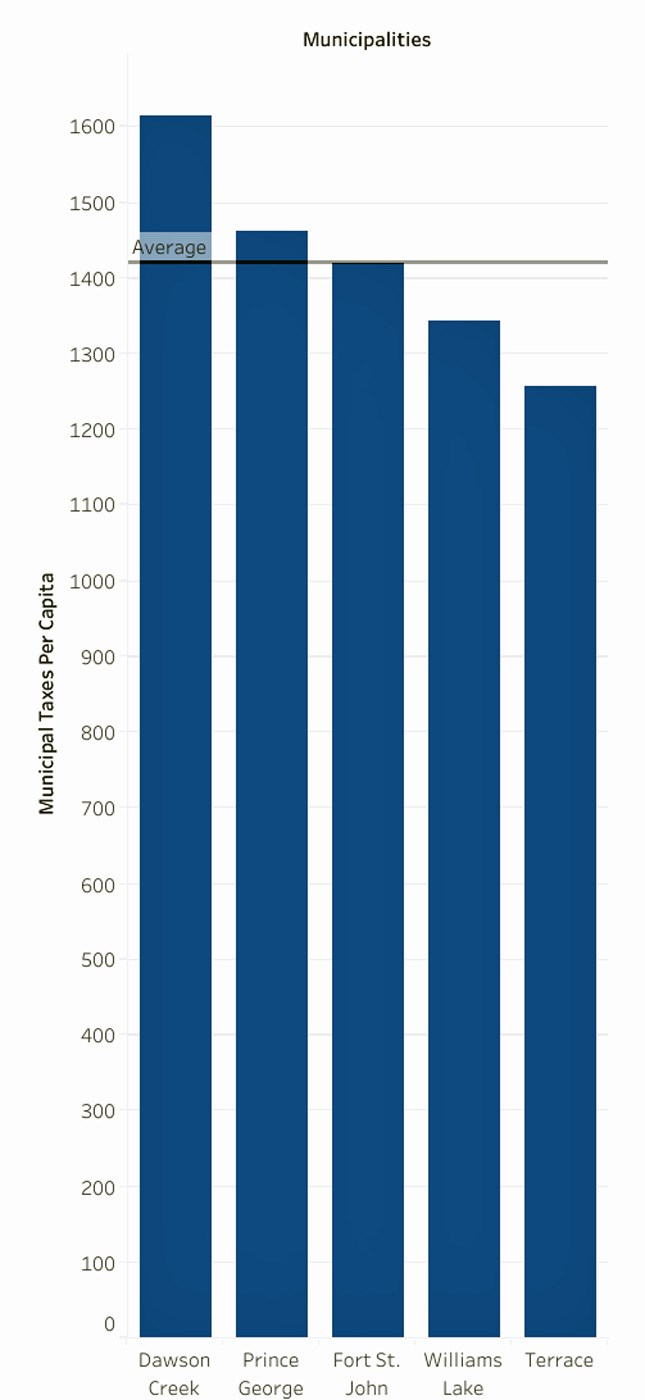

Prince George has the second highest tax rate for northern communities with a population greater than 10,000. It is not the snow or the north.

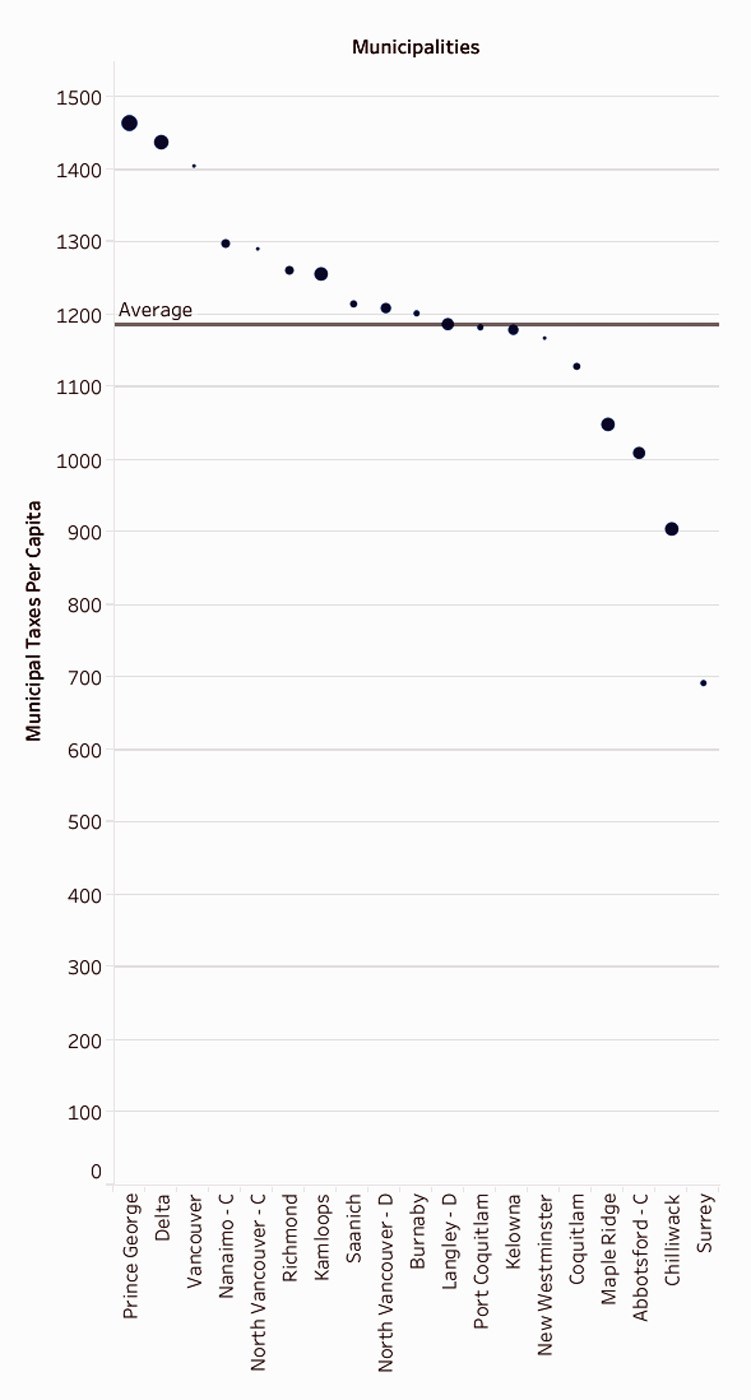

Prince George has a very high tax rate per capita, even when compared against other municipalities for area per resident and total roadway length per resident. It isn't that we have a more rural spread of town. If anything, municipalities (population greater than 50,000) with a larger area per resident seem to have lower per capita taxes, except for Prince George.

Below is a graph comparing municipal taxes per capita against the area per resident. The circle's height is the tax rate per capita, while the size of the circle is the area per resident.

The proposed 7.23 per cent property tax is 28 per cent higher than the average 2023 increase for B.C. municipalities greater than 50,000 population. This increase will move Prince George to be 25 per cent greater than the provincial average for municipal taxation per capita for communities 50,000 people or greater, excluding the capital.

The proposed tax increase is significantly larger than the wage growth in Prince George (or B.C. on average). The 7.23 per cent proposed property tax increase is 64 per cent higher than the average wage growth. This means that Prince George's residents will have to fund these tax increases by deferring other spending, alongside a larger increase in goods and services inflation.

I have made a dashboard freely available to the public and it is based on the provincial government data set.

I am sure you are aware that relative to other similar municipalities, Prince George's share of taxes falls to a greater degree on the business community. We have a more extensive industrial tax base than average and our proportion of taxes on industry is high. I'd be happy to provide a more detailed analysis on this for you but Prince George is not competitive for business in terms of municipal taxation. As businesses move or choose to never be in Prince George, this problem will get worse as we will have to continue to increase taxes on the remaining businesses and residents.

Lisa Handley

Prince George