As my fellow columnist, Bruce Strachan, noted last week, Brian Topp in his quest for leadership of the NDP party has released a "tax the rich" agenda. It is unfortunate because that is not, in my opinion, the real issue nor the solution.

The "Occupy Wall Street" crowd are in the same boat. They know that there is something wrong with system and that it needs fixing. Some have suggested simply taxing the wealthiest families that control over half of the income in the United States. But simply taxing the top 1 per cent is not the answer.

A tax on the wealthy will not solve the problem because the poorest individuals in our society are not overtaxed. They are underpaid. At least on a relative scale.

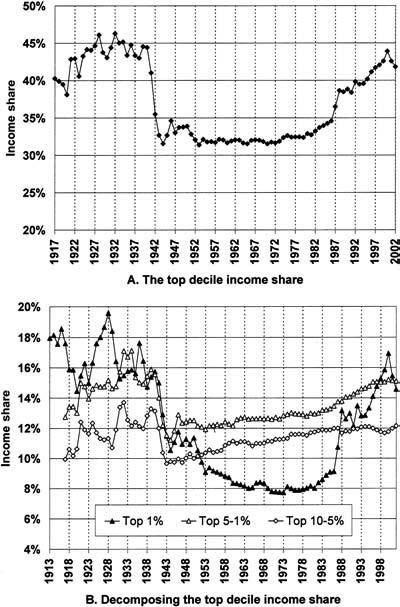

The accompanying Figure is from a paper entitled "The Evolution of Top Incomes: A Historical and International Perspective" by Thomas Piketty and Emmanual Saez. It is focused on U.S. findings but is generally applicable to Canada as well.

At issue is the income share of the top 1per cent. Note that it peaked in 1929 at some 20% of all of the income. The Great Depression took care of that and the disparity between what the rich make and the rest of us declined until, for the period between 1947 and 1977, it remained relatively constant at around 8%.

Over the last thirty years, though, the rich have been getting richer relative to the middle and lower classes. The result is that income disparity peaked, again, in 2008. And what happened? Another crash.

With a difference, though, since the Great Depression taught us much. Some companies were deemed to be just "too big to allow to fail." The whole system wasn't allowed to reset.

So, we have avoided the economic damage that a depression can bring. But there is still the issue of income disparity that needs to be addressed. Taxing the rich won't make it go away. Instead, we need to find a way to ensure that - to use an old phrase - the "rising tide of riches raises everyone's boat."

We need to find ways to ensure , for example, that there is affordable housing. In Vancouver, just off of Cambie, a news report last week had houses selling for as much as $3.4 million. Ordinary, nothing special, run of the mill houses selling into the millions. Who can afford such housing when B.C. has an average wage of $830 per week?

It is our wages that are out of whack with the costs of living. Taxing the rich won't solve that. Instead, we need to address the wage gap.

Or we will have more protests like "Occupy Wall Street" and a "tax the rich" agenda.