TORONTO — Two of Canada’s richest families appear poised for a battle over one of the country’s most famed documents.

A holding company owned by David Thomson, the billionaire chairman of Thomson Reuters, announced in new court filings Thursday that it wants to buy the royal charter that formed the Hudson's Bay retailer. Thomson is willing to spend at least $15 million on the historic document he wants to donate to the Archives of Manitoba.

Thomson's filing could become a hurdle for the department store, which is due to ask a court on Sept. 9 for permission to sell the charter for $12.5 million to Wittington Investments Ltd. The holding company belonging to the Weston family, which is best known for its grocery conglomerate Loblaw Cos. Ltd., wants to donate the charter to the Canadian Museum of History.

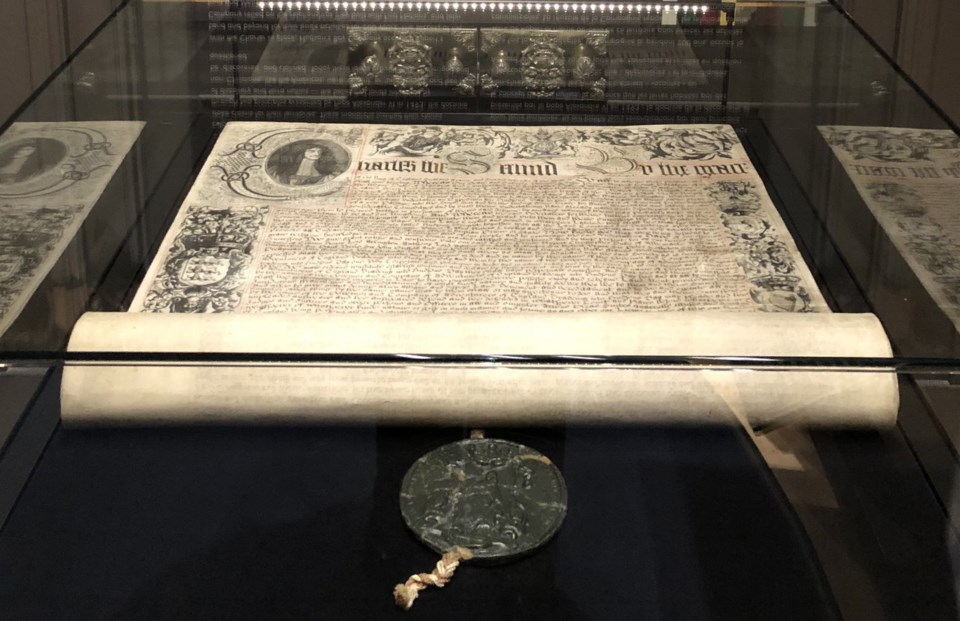

The charter was issued by King Charles II in 1670 and gave the Bay rights to a vast swath of land spanning most of Canada and extraordinary power over trade and Indigenous relations for decades.

When the Bay filed for creditor protection under the weight of immense debt in March, it started looking to assets to recoup cash for the lenders, landlords and suppliers it owed money. After closing all 80 of its stores and another 16 under the Saks banners, it turned to its 2,700 artifacts and 1,700 art pieces.

The Bay was going to auction off the items, including the charter, until the Westons' offer emerged, scuttling the original plan.

News that the Bay had already brokered a sale surprised Thomson, who had "been waiting for the timeline and process for the art auction to be announced," said Patrick Phillips, a director at Thomson's holding company DRKT, in an affidavit.

Thomson is one of the country's most prominent art collectors, building on a passion shared with his late father Kenneth Thomson, who donated 2,000 works to the Art Gallery of Ontario and gave it a $20 million annual endowment.

David Thomson was also a store manager at the Bay's Cloverdale Mall location in Etobicoke, Ont., in the 80s and president of department store Simpsons Ltd., which the Bay bought.

Thomson thought the Westons' offer was "significantly lower" than what the charter could fetch and "does not maximize value for creditors," said Phillips who said he was also "taken aback" by the sum.

Rather than move forward with the sale to the Westons, Phillips' affidavit suggests the Weston family's offer should serve as a minimum bid in an open auction.

If a court agrees to that approach, the affidavit says Thomson is willing to place bids beyond his initial $15 million offer.

"Put simply, David believes, as do I, that the Royal Charter will realize a substantially greater price in an open art auction than is currently being offered," Phillips said.

This report by The Canadian Press was first published Aug. 21, 2025.

Tara Deschamps, The Canadian Press