In May 2022, Vancouver-based General Copper Gold Corp. announced it had raised $748,000 through the sale of shares to explore the Topley Richfield property, located eight kilometres north of the village of Topley, B.C. – roughly 277 km west of Prince George.

Back in May 1927, the Topley Consolidated Mining and Development Company – led by Frank Taylor, the prospector who discovered the Topley deposits in 1926 – issued a million shares to raise $250,000 (nearly $4.45 million in 2022 dollars) to develop the site. After Taylor and company packed up in 1929, mineral exploration rights to the site have changed hands at least 10 times, drawing players as large as Cominco (now part of Teck Resources Ltd.) and Esso Resources Canada in the 1980s.

But the closest anyone has come so far to striking it rich in Topley Richfield is when a run on mining stocks on the Vancouver Stock Exchange in April 1928 caused the price of shares in Taylor’s Topley Consolidated Mining and Development Company to triple in value, from $0.25 to $0.75 per share, in three days of trading.

General Copper Gold Corp. president Michelle Gahagan did not respond to a Citizen request for an interview.

"General is very excited to add Topley to our portfolio with a view to following up on previous drilling. Analysis of the historic drilling appears to indicate an epithermal system and our plan is to test the identified fold axis which sits quite near surface,” Gahagan said in a statement issued on July 20, 2021. “With the excellent infrastructure and our local logistics partners, we will be able to make significant progress quickly and affordably.”

A statement issued on May 5 by the company said it will use the funds raised through the issue of shares for exploration at the 2,313-hectare Topley Richfield property, which includes seven contiguous claims.

“Topley Richfield is a historic mining area with previous work carried out in 2008, 2015 as well as geophysical surveys in 2021,” the statement said. “There are significant historical drilling intercepts and the 2021 geophysics has highlighted further key highly prospective areas that have yet to be explored. Multiple drill targets have already been identified by the Company.”

On July 27, 2021, General Copper Gold Corp. (then called General Gold Resources Inc.), announced it had acquired a 50.1 per cent interest in the Topley Richfield property from Deep Blue Trading Inc., for $200,000 and two million common shares. The deal was part of an agreement, announced seven days earlier, to allow General Copper Gold to buy up to 100 per cent interest in the property from Deep Blue over the course of 12 months.

“It is accessible by road, power runs through the western side of the Property and the village of Topley is less than 10km away,” the company’s July 27, 2021 statement said. “Previous exploration has focussed on expanding the known mineralization. General will use the data from historic work to inform the current drilling program.”

‘MAKE A STAKE… OR GO BROKE’

On Jan. 27, 1927 the Citizen reported that Taylor “is going to make a stake at Topley or go broke.”

Taylor had invested $10,000 (nearly $170,000 in today’s dollars) he’d earned from other mining properties into buying up options from other prospectors in the Topley Richfield area. In addition, Taylor purchased a townsite surrounding the railway station at Topley.

At the time the Spokane, Wash.-based Standard Silver-Lead company was conducting work in Richfield, but by a July 21, 1927 report in the Citizen, the American company had abandoned the venture and Taylor’s company was looking to acquire their mineral rights.

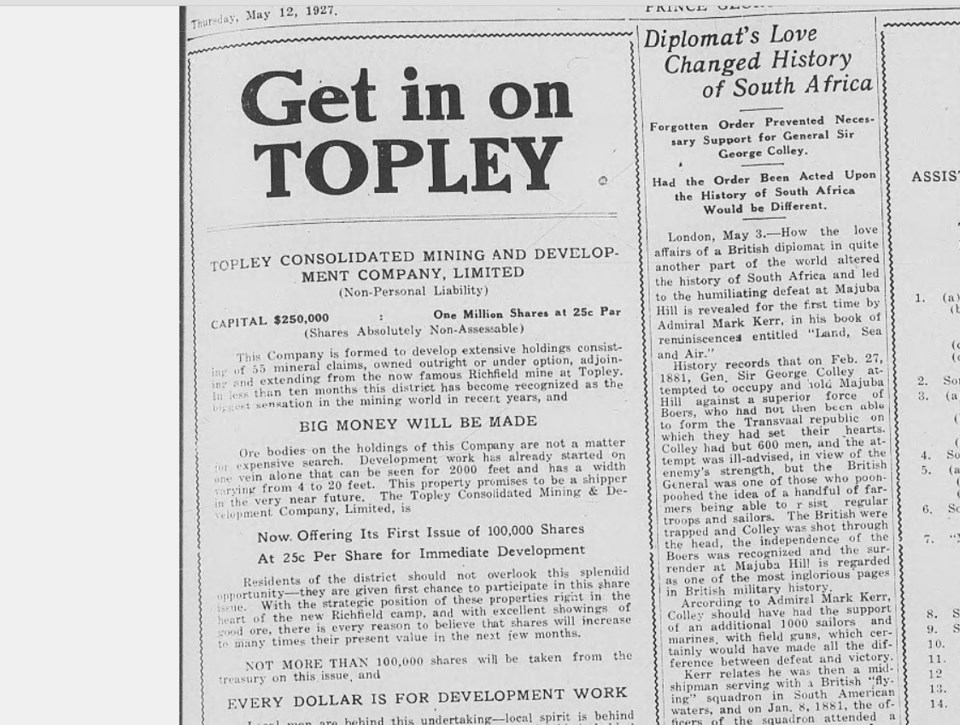

When Taylor and his company were issuing shares to attract capital, an advertisement posted in the Citizen by the company boasted the company owned or had options on 55 mineral claims in the “now famous” Topley Richfield area.

“In less than 10 months this district has become recognized as the biggest sensation in the mining world in recent years, and BIG MONEY WILL BE MADE,” the ad said. “Ore bodies on the holdings of this Company are not a matter for expensive search… This property promises to be a shipper in the very near future.”

While some shareholders “made handsome clean-ups” when the company’s stock prices tripled in April 1928, the mine never became “a shipper.”

Despite promising finds of gold and silver announced in late November 1928, Taylor and his partners folded their operations at Topley Richfield in 1929.

A Citizen editorial, published in Jan. 9, 1930, said that operation closed down with $200,000 left in the treasury and $50,000 in equipment at the site. The company had dug 1,600 metres of underground works on two levels, accessed by an inclined shaft, along with substantive drilling, but no mining was done, according to an engineer’s report from 1999.

“Investors in all mining ventures are called upon to take two main chances. One is on the mine, and the other on the management. The shareholders in the Topley-Richfield missed it on their mine but made good on their management, as all are agreed the affairs of their company were intelligently directed and economically managed,” the Citizen wrote.

Taylor and company took an option on the Three Star group on Boo Mountain, about 14 km northwest of Decker Lake, “on which it is believed it stands a fair chance to make good.”

30,000+ KILOGRAMS OF SILVER

In a May 2007 report on the Topley Richfield site, Stephen Wetherup of Caracle Creek International Consulting Inc., outlined the history of site throughout the 20th century.

Toronto-based NXA Inc. had just acquired the rights to the site from a numbered Ontario company, and Wetherup and his colleagues were hired to conduct an inspection and report on the site in 2006. The report has been made public by the B.C. Geological Survey.

By the time Wetherup visited the site in 2006, Taylor’s mines were no longer accessible.

After Taylor left, in 1937 new owners discovered a gold-bearing structure roughly 300 metres east of the original underground mine. Some surface stripping and 50 metres of underground works were conducted at that site, according to the 1999 engineering report.

Between 1938 and 1953, a total of 43 tonnes of ore were mined – resulting in the recovery of nearly 27 kg of silver (worth about $22,350 today), 31 grams of gold (worth less than $2,300 today), 9.5 tonnes of lead and 4.3 tonnes of zinc.

The Topley Mining Syndicate ended operations in the early 1950s, and ownership passed to Silver Standard Mines, which dewatered the historical mine shafts and did test drilling between 1955 and 1958.

Then in 1967, Seemar Mines Ltd. did extensive drilling and used ground magnetics to look for metal deposits.

In 1975, Canadian Superior Exploration Ltd. conducted the first induced polarization (IP) and resistivity survey of the site, Wetherup wrote. The company drilled four holes in the area of the old mine works, and intersected the area between the two mine levels.

Between 1979 and 1981, Cobre Exploration Ltd. brought more modern technology to bear on the old mines.

“Cobre Exploration calculated reserves of 181,000 (tonnes) with grades of 5.0-10.6 (grams per tonne of gold) and 62.2-248.8 (grams per tonne of silver),” Wetherup wrote.

Cobre Exploration’s findings clearly elicited interest in the Topley Richfield site, because in 1982 and 1983, Canadian mining giant Cominco Ltd. had acquired the rights to the site and was conducting its own geophysical survey.

By 1987, ownership had passed to Esso Resources Canada Ltd., which was later amalgamated into petrochemical giant Imperial Oil. Esso Resources Canada conducted further exploration of the site, reporting in 1988 reserves of 170,000 tonnes, grading at 3.9 grams of gold per tonne and 177.3 grams of silver per tonne – the equivalent of 30,141 kg of silver (worth roughly $25.6 million at today’s prices).

However, those vast reserves didn’t result in action by major mining players like Cominco or Esso Resources Canada.

By the 2000s, ownership of the site had passed back to small mineral exploration companies; NXA Inc. bought them from a numbered company in 2006.

In May 2019, Bloomberg reported that Pacific Empire Minerals had purchased the rights. Leading up to General Copper Gold Corp. making its stake in Topley Richfield last year.

Only time will tell if Frank Taylor’s mine will ever become “a shipper.”

EDITOR'S NOTE: A previous version of the this story incorrectly reported the estimated, in-ground silver reserves at Topley Richfield. The Citizen apologizes for the error.