With two days notice, Peter Fletcher was slammed by the fact he would not be getting the guaranteed income supplement he usually did to round up his CPP and old age security pension this year because he accessed the Canada Emergency Response Benefit (CERB) for caregivers last year.

Fletcher, who recently moved to Prince George from Ontario where he looked after his aging cancer-ridden landlady, said he needed the money for the added expenses that came with making sure his landlady was safe when she went to her many medical appointments and treatments. She also had mobility issues he would even help with her errands including trips to the grocery store.

He knew he’d have to pay the benefit back but what he didn’t know was that it would affect his annual income, making him ineligible for the guaranteed income supplement (GIS) the following year.

“When the application had been done on the phone it was never indicated I would have to give up the guaranteed income supplement,” Fletcher said. “It did indicate I would pay it back and I acknowledge that.”

When he applied for the CERB, the information that was provided to him was that he wouldn’t have to pay penalties or interest when it was time to repay the sum he took of $14,000 over several months. A follow-up letter confirmed that information.

But that information was not accurate.

“When I got the assessment in the mail it indicated I needed to pay interest,” Fletcher said. “I thought everything was going fine. I made arrangements with CRA (Canada Revenue Agency) to pay on a monthly basis then eight weeks later I get the letter from Service Canada indicating that my GIS is being declined due to the fact that I had a higher income, which was the $14,000.”

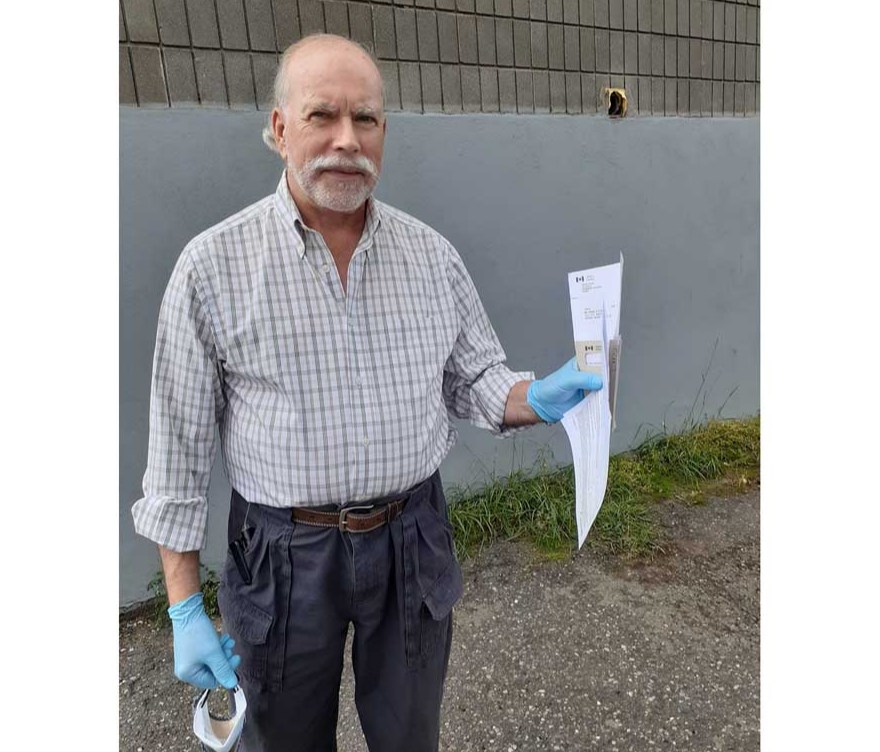

Fletcher decided to see if he could change this outcome and made an in-person visit to the local Service Canada office but was told their policies were set and they would not sway from them.

“At this time nothing has developed in my favour,” Fletcher said. “CRA has acknowledged they would give me a leeway of 90 days that I negotiated with them but I don’t have that money now.”

He is currently paying only the interest back because that’s all he can afford. He needed the guaranteed income supplement to help pay back the CERB.

“It’s $355 a month - you get two days notice, which is ridiculous,” Fletcher said. “If that was going to happen they should have sent a letter out to everybody indicating there was going to be a supplement change but it was an immediate change and I don’t think that was fair at all.”

That’s when Fletcher visited the offices of the local MP to try to get some help.

He’s gotten lots of support, taken all the action recommended to him including sending a form letter that was acknowledged by Service Canada with another letter soon to be sent off to Revenue Canada but nothing has changed as yet.

He’s still working on it and he said he knows he’s not alone and wanted to bring attention to the plight of those who are in similar circumstances.

“This is a dramatic amount of money (the guaranteed income supplement) - my only other income is the CPP and old age security,” Fletcher said.

Ultimately, Fletcher is hoping to get his GIS back so he can pay off the CERB, he added.

He believes the government in their effort to help those in need were too quick to act and didn’t think the whole thing through.

“I don’t blame them for that but it’s not good to ignore the situation for the Canadian seniors who had the need to take the extra CERB income - it’s going to put them all in the same scenario I’m facing,” Fletcher said.

The good news is he is now considered a low-income senior so he will once again be eligible for the GIS next year but that doesn’t solve his current financial shortfall.

“I think the government has to offer some leeway to alleviate the situation,” Fletcher said. “They’ve extended the time for repayment but the situation needs to be addressed for not only me but for all Canadian seniors’ immediate needs.”

.jpg;w=120;h=80;mode=crop)