During budget discussions Monday night (Jan. 6), city council approved the 2020-2024 financial plan that will see taxes go up by at least 2.15 per cent this year.

Talks started with general operating expenses increasing by $2,098,194, which represents an increase of 1.89 per cent.

That includes the snow control budget remaining at $8,500,000 — the same amount allocated in 2019.

The road rehabilitation levy is also set at the same target as last year which is $5.65 million.

The proposed tax levy increase before the additional enhancements were considered. (via City of Prince George)

The proposed tax levy increase before the additional enhancements were considered. (via City of Prince George)However, council approved a number of enhancements requested by police and the planning department, which saw the 1.89 per cent property tax levy, increase to 2.15 per cent.

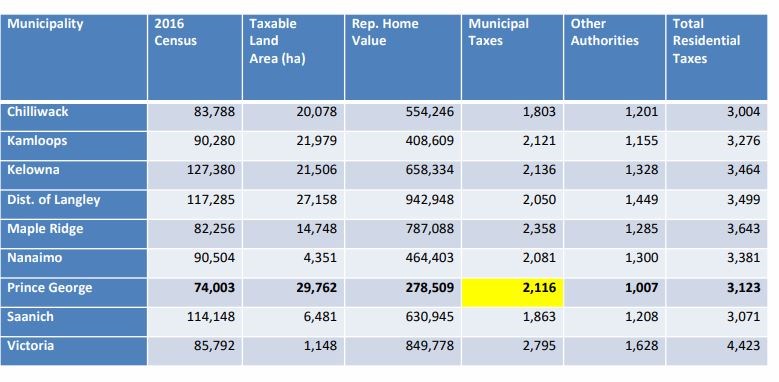

“We are still being comparable even though we have a very unique challenge in Prince George,” said City Director of Finance Kris Dalio, noting Prince George’s municipal taxes are similar to other sizable cities who have smaller geographical boundaries like Nanaimo and Kamloops.

Comparing Prince George with other municipalities. (via City of Prince George)

Comparing Prince George with other municipalities. (via City of Prince George)Two of the approved enhancements to see the levy jump include requests from Mounties for a data processor supervisor position and a forensic video analyst.

“There’s been several court rulings that have put additional pressures on us with regards to timelines and providing materials to crown council in order to meet timelines for trials,” said Prince George RCMP Superintendent Shaun Wright, regarding the need for a data processing supervisor to oversee the other two data processors.

“As we don’t have adequate depth in our support units we’ve utilized regular police officers to fill some of those roles. They are not as efficient as specialized support staff and they are more expensive if they are utilized on overtime to do those duties.”

Wright said the line of reasoning for the request of a forensic video analyst was essentially the same.

“We’ve experienced what I would describe as an explosion in video. Be it video doorbells or dash cameras, that sort of thing. We are seizing hundreds and hundreds sometimes thousands of hours of video,” said Wright.

“This position would give us additional capability in sorting through those things and expert analysis of materials for the prosecution of major cases and consolidate the duties being performed by regular police officers now with regards to downloading and analysis of cell phones and some computers.”

The planning department also requested an additional planner to keep up with the workload of the record-breaking number of building permits that have been seen in the city over the past few years.

“We have had record-breaking development numbers but the volume is being born by that staff and they’ve been running pretty shy for a while and they could use that support,” said Dalio. “The trend is showing that it’s not showing down as we have had three straight years of this activity. “

Council differed two other requested enhancements to come to the table in late February: the downtown, safe, clean and inclusive package and the climate change and energy coordinator position.

The proposed downtown enhancements were deferred specifically until the Select Committee on A Safe Clean and Inclusive Downtown, formed on Dec. 17, had the opportunity to meet.

“We will not deal with until the committee has had an opportunity to meet because we could see recommendations come from the committee that could affect operations or the capital side of the budget,” said Mayor Lyn Hall at the start of the meeting.

The financial plan bylaw and tax rate bylaw must be passed before May 15 of each year.