City council will be advised to approve a two per cent increase to the property tax levy for 2021, when it meets to deliberate the annual budget in January.

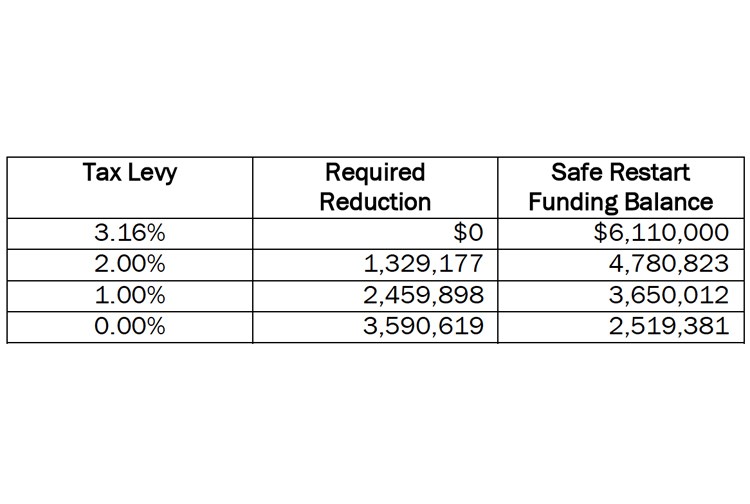

On Monday, the city's standing committee on finance and audit approved a recommendation calling for the two per cent hike to the tax levy. In a report to the committee, city director of finance Kris Dalio said in order to maintain service levels, the city would need to raise an addition $3.59 million – equivalent to a 3.16 per cent property tax increase.

However, he said, the city received $6.11 million from the provincial government's Safe Restart Grant program that can be used to cover some or all of that amount for the year.

"The intent (of the Safe Restart Grant) is literally for the offset of COVID impacts," Dalio said. "It's a one-time funding source. The exercise is to use that Safe Restart funding until we get back to normal."

The proposal put forward in a motion by Mayor Lyn Hall, and subsequently amended by Coun. Cori Ramsay, would use $1.33 million of the grant money in 2021 to reduce the tax levy increase to two per cent, leaving $4.78 million for future use.

Ramsay said the committee could recommend using the grant to cover the full $3.59 million, resulting in no tax levy increase in 2021, but that would only leave $2.52 million to help cover further costs and lost city revenue in 2022.

"I don't want the taxpayers to be hit with a five per cent tax increase in 2022," Ramsay said.

In his initial motion, Hall had proposed the committee recommend limiting the tax levy to a one per cent increase. Under that proposal, the city would use $2.46 million to offset the taxes in 2021, leaving $3.65 million for future use.

"My personal opinion is we're going to face revenue shortfalls through 2021, running into 2022," Hall said. "To me, it's about being conservative about that $6.1 million."

Ramsay said that recommending two per cent gives city council more flexibility when it comes to budget deliberations in January. It would be hard "in terms of public perception" for council to approve a tax increase higher than the committee's recommendation, she said.

Committee chairperson Coun. Garth Frizzell said he agreed the recommendation of two per cent would give council "more wiggle room" to make a decision, but he'd like to see council give taxpayers more of a break.

"I agree with the one per cent, and think we may get there in the end," he said. "(But) we don't need to spent the kitty – there may be rainier days ahead."

The fourth member of committee, Coun. Frank Everitt, wasn't able to attend the meeting. However Coun. Kyle Sampson and Susan Scott sat in on the meeting as ex-officio members.

Sampson said council will need to consider longer-term solutions to controlling costs.

"The $6.1 million is not an ongoing funding source. It's just kicking that problem further down the road," Sampson said. "How do we find that balance, and give people a bit of a break right now. I appreciate that we've got to a point of 3.16 per cent – that six per cent earlier in the year was daunting."

In July the city was predicting it would face a $6.4 million shortfall in 2021, equivalent to a 5.63 per cent tax increase.

In his report to the committee, Dalio said the restructuring at city hall resulted in the reduction of eight exempt and four unionized positions – in addition 44 staff who work at the Prince George Conference and Civic Centre, Elksentre and Four Seasons Leisure Pool are laid off while those facilities are closed. Dalio said his financial projections assume those three facilities will remain closed throughout 2021.

"The exempt and management staff have committed to zero per cent increases over the next two years," Dalio added.

The Prince George Public Library also committed to zero per cent budget increases until 2023, Dalio said.

As a result, the city expects its labour costs to be $1.9 million lower in 2021.

In addition, the city realized $3.15 million in non-labour expense reductions, he said. Having those buildings closed saved the city more money than he initially predicted.

"Our Hydro and gas has come in about a million dollars under budget," he said.

Provincial funding to offset transit losses due to the COVID-19 pandemic mean the city didn't end up losing as much money as expected to keep busses running, Dalio added.

In addition, while the city is still projecting to see its revenues down $5.3 million from a normal year, the losses in revenue haven't been as bad as initially projected, Dalio said.

"Development revenue was one of the ones we thought would take a big hit. But actually, things have come in at a relatively normal year," he said.

Taxes on new construction are expected to contribute $1.3 million to the city's bottom line in 2021.

A two per cent increase in the tax levy – the total amount of money the city looks to raise through property taxes – doesn't necessarily equate to a two per cent increase in the property tax rate paid by property owners. Once city council formally approves the tax levy amount during its Jan. 25 and Jan. 27 budget meetings, the tax rates will be calculated to collect that amount, based on the property assessments issued by BC Assessment next year.