When parents separate, Canadian law requires that both parents contribute to their children’s support. This usually means the parent who spends less time with a child pays “child support” to the parent who spends more time with the child. But who counts as a parent? How long do they have to pay? And how much?

These aren’t always easy questions. This column offers some very basic information about child support and some ways to learn more.

Who has to pay?

A parent can be required to pay, whether the parent is a birth parent or adoptive parent. In some circumstances, a stepparent may be required to pay. A person who is a guardian of the child under the Family Law Act can also be required to pay child support.

For how long?

In BC, parents and guardians must support a child until the child turns 19, and sometimes after that if the child is still dependent on their parents.

How much?

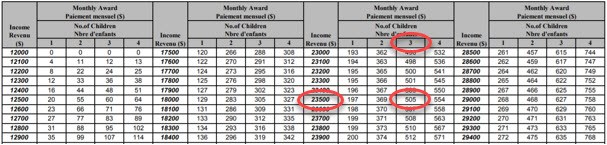

The Child Support Guidelines Tables are used to determine the amount of support payable. These are charts (called “tables”) that set out the amount of support a parent or guardian should pay, based on that person’s income and the number of children to be supported. There are tables for each province. You use the table for the province where the person paying support lives.

Because child support is based on the payor’s income, it’s essential to have accurate and complete information about that parent’s income. That’s why the law requires the person paying support to complete a Financial Statement using Form 4 and provide income tax returns, pay stubs and other documents before a judge makes a child support order.

Simplified Tables

A simplified copy of the tables is found here. To use the simplified tables, click on one of the two choices for the province where the person who will pay support lives. Choose the table matching the number of children that person is required to support, either:

1. one to four children, or

2. five or more children.

That will take you to a specific Child Support Guidelines Table like the one shown here.

Look for the support payor’s income on the left of a row and the number of children at the top of a column. The column and row will intersect at a number, and that’s the monthly amount of basic child support.

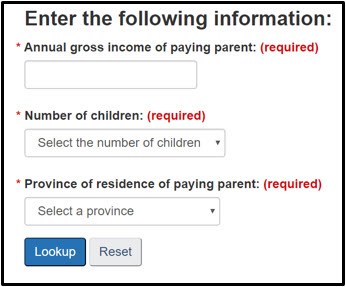

Child Support Calculator

You may find it easier to use the Child Support Calculator. If you fill in the payor’s income, number of children and province of residence, it gives you the basic or “table amount” of child support payable.

Paying higher amounts

A payor may be required to pay more than the basic amount to contribute to special or extraordinary expenses. You may hear it called “section 7 expenses,” referring to section 7 of the Federal Child Support Guidelines where the law about these expenses is set out. These types of expenses can include things like childcare, post-secondary schooling and medical expenses. Calculating the contribution to special expenses can be complicated – if there are special expenses in your case, it’s a good idea to talk to a lawyer to learn about the law.

A judge may also order a parent or guardian to pay more than the “table amount” for their reported income if there is evidence they are intentionally unemployed or under-employed. In that case the judge can “impute” more income than they actually earn, and base their child support on the higher amount.

Paying lower amounts

If the payor has a lower household standard of living than the parent receiving child support and paying the basic table amount of child support would cause them undue hardship, a judge may be able to lower the amount. However, in BC “undue” means "exceptional, excessive or disproportionate" hardship. Problems like having a lower standard of living or having to support a new family are not enough to justify paying a lower amount of child support.

There are special rules for calculating child support when the parenting arrangement amounts to split or shared custody.

More information

Calculating the income of the person paying support, the amount of support that should be paid, and whether any exceptions apply can be complicated. It is important to speak to a lawyer and/or a Family Justice Counsellor to get more information.

For more information about child support, see the Wikibook JP Boyd on Family Law, the BC government’s Family Justice website and the Federal Child Support Guidelines.

Find out how to contact a Family Justice Counsellor and how to find a lawyer or legal advice.