The economy of northern B.C. has largely stabilized since the downturn in commodity prices in 2014, according to a new report by the Northern Development Initiative Trust and accounting firm MNP LLP.

In his introduction to the report, Northern Development CEO Joel McKay said that prior to the report, up-to-date economic data about the north was difficult to find. Because of that many business and community decisions are based on assumptions or anecdotal evidence about the state of the economy in the north, he wrote.

"The data is clear that the decline in commodity prices in 2014 had a significant impact on the regional economy," McKay said in a statement. "The good news is that the data also shows that economic conditions in the region have stabilized more recently, and major project activity across the region has created opportunities for new investment."

According to the report there are not statistics gathered to show what the GDP of the north is, or even a single definition of what constitutes northern B.C. Different sources define the north in different ways and subdivide it in different ways.

However, on a 10-year average roughly 78 per cent of the province's commodity exports -worth $24-30 billion annually - come from rural B.C., which includes the north, parts of Vancouver Island, Okanagan and Kootenays.

"For example, in 2016 alone, forest and energy product exports account for 56 (per cent) of the total value of B.C.'s exports, or about $21.5 billion," the report says. "Yet this data doesn't account for service exports and their contribution to our total trade balance. Still, it's clear that without rural B.C., and northern B.C. as the largest part of it, B.C. would suffer from an incredible trade deficit."

While 2011-14 saw economic growth in the north due to activity in the commodity sector, economic growth has stagnated since 2014 due to declines in oil and gas exploration, mine closures, and delays or cancellations of major oil and gas pipeline projects.

The U.S. imposition of duties on softwood lumber starting in April 2017 has "lowered growth expectations for the forest sector," the report said.

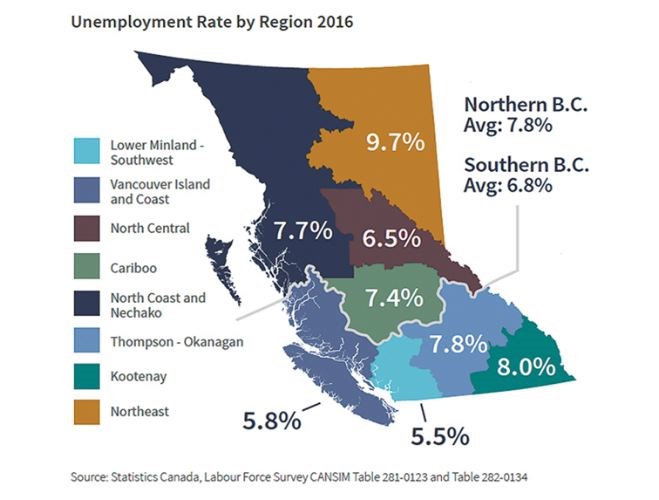

Unemployment rates in the north have been rising. In 2016 the average unemployment rate across the north was 7.8 per cent, compared with 6.8 per cent in the southern half of the province, the report said. However in the north central region, which includes Prince George, the average unemployment in 2016 was 6.5 per cent.

"In Prince George the unemployment rate is lower in line with unemployment rates in other urban areas in B.C.," the report says. "The north central region has the most diverse economy in northern B.C. In addition, to having a significant forestry sector, the region also has the University of Northern British Columbia, the University Hospital of Northern British Columbia, and a range of suppliers of equipment and professional services. This suggests that the region's employment is more diverse than in other regions of northern B.C. and less dependent on cyclical factors such as commodity prices."

The north central area around Prince George has also bucked the regional trend in new housing starts, with a steady increase from 2014 to 2016. New home construction across the north as a whole has declined.

While housing prices have risen, the north central area has the lowest cost of living in the north "likely reflecting a combination of relatively low transportation costs and lower food costs compared with other parts of northern B.C," the report says. Wages in the region are similar to other parts of the north

However, the population in the north central region has been declining since 2014. Between 2011 and 2016, the north central region has had a compound annual population change rate of -0.4 per cent.

"Between the 2011 and 2014 the population of the north central region grew modestly (less than one per cent). Since then the population has declined and is now below its 2011 level," the report says. "Population growth rates reflect the economic health of a region. Growth in population occurs as people move in search of economic opportunities or for lifestyle factors."

In 2016 the area, centered around Prince George, had a population of 112,287 - 34 per cent of the total population of the north -down from 114,677 in 2011 and the peak of 115,564 in 2014.

The total population in the north rose from 333,986 in 2011 to 338,283 in 2014, before declining back to 332,386 in 2016.

"International immigration is not a significant favor in population growth in northern B.C. and most migration, both to and from the region, is people moving within the province," the report says.

Approximately 70 per cent of people moving to and from northern B.C. between 2010-11 and 2015-16 moved within B.C.

A total of 5,387 businesses operated in the north as of 2016, and 86 per cent of them were small businesses with less than 20 employees.

"The overall number of businesses with employees in the north central region has been relatively stable since 2011," the report says. "There is some indication that there has been a modest growth in the number of businesses in the agriculture, forestry, fishing, manufacturing and other service sectors."

The report said there has also been signs of business growth, with the number of businesses with 20 or more employees increasing.

However, new business formations in 2016 were below their three-year average. A total of 1,131 new businesses formed in northern B.C. in 2016, below the 2013-15 average of 1,412 per year.

Across northern B.C. there were 446 personal bankruptcies and seven business bankruptcies in 2016.

"Personal bankruptcies in northern B.C. have declined substantially since 2011, and in 2016 were below their five-year average," the report said. "The number of business bankruptcies has remained stable. This suggests that economic conditions have stabilized."

The full, 78-page report is available online at bit.ly/2mhTRAj, and delves into further detail on each region and major employment sectors.

Northern Development chairperson Evan Saugstad said the report will provide concrete information to inform public policy on economic development in the future.

"As the north's economic development organization, it is important that we understand the data behind the decision that are affecting the communities we serve," Saugstad said in a statement. "The State of the North report provides us with the economic context we need to better inform our own decisions, as well as those of our communities, businesses and non-profits, so that together we can build a stronger north."